Personal Finance is more than a buzzword thrown around by influencers and YouTube gurus. It’s a life skill—a real, measurable, and powerful force that separates stress from security and chaos from clarity. Whether you’re earning a steady income or building your first side hustle, mastering your money starts here.

Personal Finance Basics: Where It All Begins

Understanding money doesn’t require a finance degree. It starts with knowing what comes in, what goes out, and what stays behind. Once you grasp the essentials, you gain control—and control equals peace of mind.

Budgeting Is Not Optional

Building a realistic monthly budget gives structure to your spending. It’s not about being restrictive; it’s about being intentional. Budgeting creates clarity and helps prioritize essentials over impulses.

Emergency Funds Save Futures

Most people underestimate how quickly a medical bill, job loss, or urgent repair can spiral into crisis. An emergency fund isn’t a luxury; it’s survival. A healthy fund equals less dependency on credit cards and more power in decision-making.

Personal Finance Strategies for Income Management

You work hard for your income—don’t let it disappear unnoticed. Managing income strategically means planning, not guessing.

Track Everything

Apps, spreadsheets, or even a notebook—tracking your income and expenses is crucial. You’ll uncover leaks you never knew existed.

🪙 Diversify Your Earnings

Relying on one source of income is risky. Whether it’s freelancing, dividend stocks, or rental income, having multiple streams creates stability.

Personal Finance Tips for Saving Money Like a Pro

Saving isn’t just for the rich—it’s how people become rich. Consistent saving, even in small amounts, builds habits that shape your financial future.

Automate Your Savings

Don’t leave saving to chance or motivation. Automate it. Schedule transfers to a high-yield savings account right after each paycheck.

Spend with Purpose

Impulse buys kill budgets. Before every purchase, ask, “Does this align with my goals?” That simple pause can save thousands annually.

Personal Finance and Debt: Taking Back Control

Debt can feel like a trap, but it’s not forever. The way out starts with a plan and discipline.

Snowball vs. Avalanche: Know Your Method

The snowball method focuses on paying off small debts first, gaining momentum. The Avalanche Method targets high-interest debts first, saving more in the long run. Choose what fits your personality and stick to it.

Avoid New Debt

As you’re paying off existing debt, the worst mistake is adding more. Pause credit card usage and avoid “buy now, pay later” traps.

Personal Finance Goals: Think Big, Start Small

Dreams without financial planning are just wishes. Personal finance empowers those dreams to become achievable goals.

Buying a Home or Investing

Big goals like home ownership or investing require long-term discipline. Start early, research deeply, and consult unbiased advisors.

Education, Travel, or Starting a Business

Whatever your ambition, break it into actionable steps. Save with a purpose, and set a timeline. Track progress monthly and adjust as life changes.

Personal Finance and Credit Score Wisdom

Your credit score impacts loans, insurance, and even job applications. Treat it as a financial passport — and maintain it with care.

Pay Bills On Time—Always

Late payments devastate your credit. Automate your bills to avoid unnecessary hits to your score.

Keep Credit Utilization Low

Ideally, use less than 30% of your available credit. This shows lenders you’re responsible and not overleveraged.

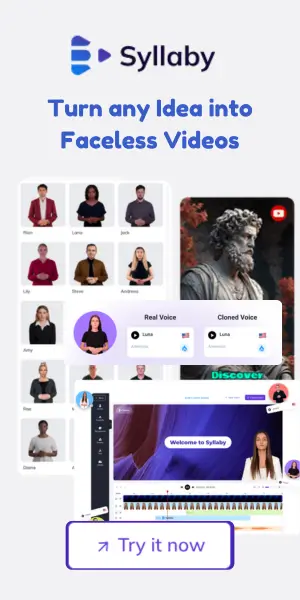

Personal Finance Tools You Should Actually Use

Not all tools are made equal. Some overcomplicate, others oversimplify. These are worth your time.

Best Apps for Budgeting and Saving

- YNAB (You Need A Budget): Perfect for goal-driven planners

- Mint: Great for beginners

- PocketGuard: Helps you avoid overspending

Smart Investment Platforms

- Vanguard for long-term index investing

- Fidelity for personalized strategies

- Acorns for micro-investing beginners

Personal Finance for Families and Couples

Money fights are the top reason relationships fall apart. Honest financial conversations can prevent that.

Budgeting Together

Joint budgets should be clear and fair. Assign roles, set mutual goals, and review spending as a team—monthly.

Planning for Children

Include future expenses like education, healthcare, and extracurriculars in your plan. The earlier you prepare, the better.

Personal Finance Habits for Lifelong Success

Habits, not income, determine financial outcomes. People earning $40,000 can be more financially secure than those making $200,000—all because of daily decisions.

🪞 Regular Financial Checkups

Treat your finances like your health. Set a monthly review day to track goals, assess spending, and update your budget.

Keep Learning

The world of finance evolves—stay sharp. Follow credible blogs, listen to podcasts, or take free courses. Knowledge compounds like interest.

Personal Finance in 2025 and Beyond

With AI-driven tools, decentralization of finance, and remote income opportunities, the future looks promising—but only for the financially literate. Start now, stay consistent, and your future self will thank you.

this content is created by guestpostingmonster.com